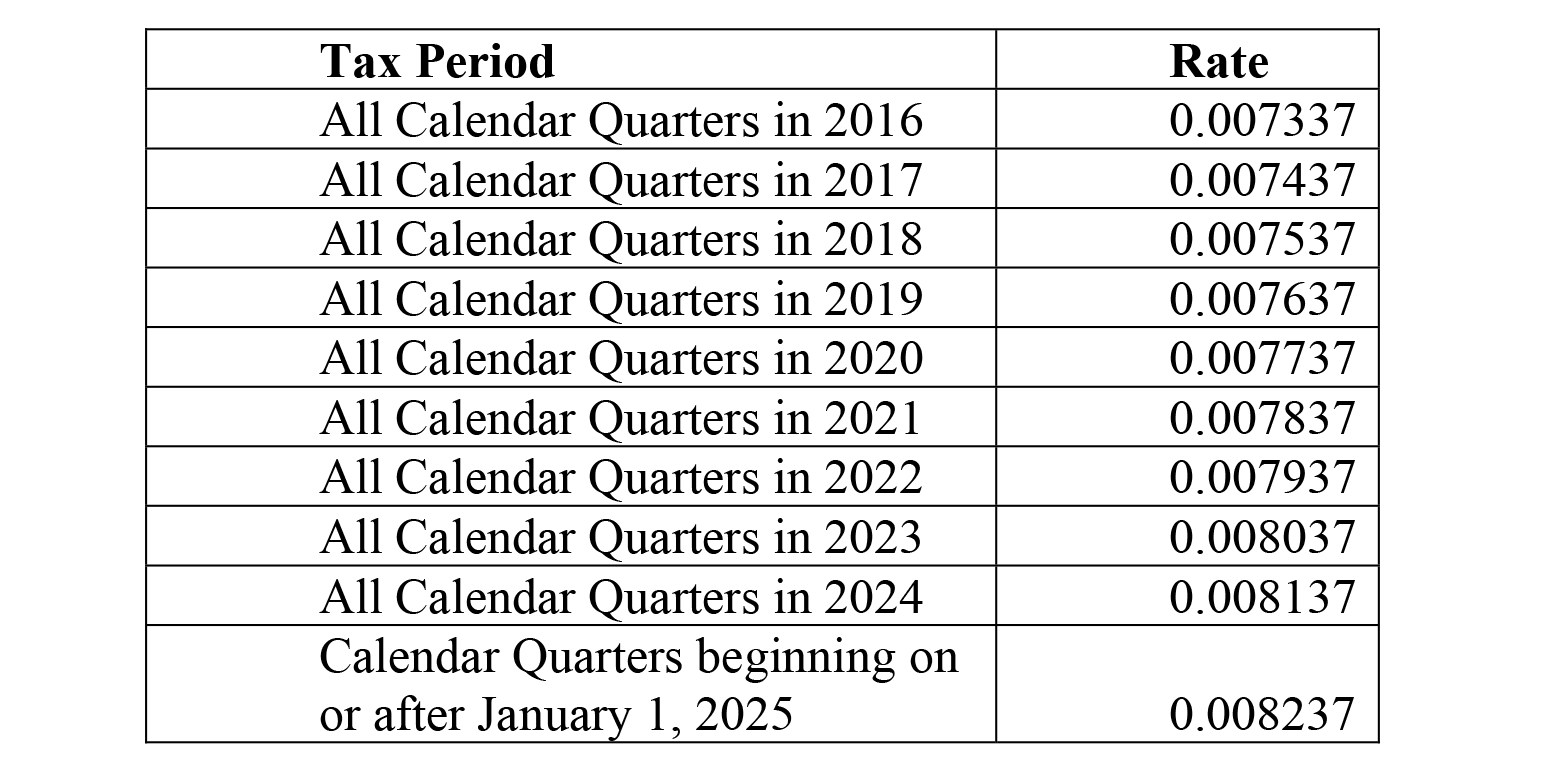

oregon workers benefit fund tax rate

You are responsible for any necessary changes to this rate. 22 cents per hour worked.

The WBF assessment applies to each full or partial.

. HB 3389 could soften the blow. Oregon Workers Benefit Fund Payroll Tax Overview. The rate is unchanged from 2021.

Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return-to-work programs. It is automatically added by payroll but requires a manual entry of the workers assessment rate for each employee and company rate. This is due to the self-balancing tax structure used to fund.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. Oregon lawmakers pass tax relief for states employers. Unemployment taxes rose for most employers this year.

For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. Rate annually in compliance with requirements in ORS 656506. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation insurance in Oregon and by all workers subject to Oregons Workers Compensation Laws whether or not covered by workers compensation insurance.

Ranking of each states workers compensation premium rates Oregon is 6th lowest. Oregons trust fund which is on track to remain solvent through the next recession is one of the healthiest in the nation. Employers and employees split the cost.

Tax Formula Set Up. No change remains at 22 cents per hour worked in 2022. General Oregon payroll tax rate information.

The purpose of the tax is to help fund programs in Oregon to help injured workers and their families. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour.

By Kate Davidson OPB June 23 2021 512 pm. The state transit tax. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

This assessment rate is printed in box 10 on. The 22 cents-per-hour rate is the employer and worker rate combined. The program will feature a fund that starting in September 2023 will pay benefits to Oregon workers who need to take time off to care for.

On Tuesday House Democrats in Oregon reintroduced a bill to give a one-time payment of 600. The Oregon statewide transit tax rate remains at 01 in 2022. 16 at 3 pm.

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers. Oregon Workers Benefit Fund Assessment Report. The Oregon Employment Department mails notifications to businesses regarding their individual tax rates and encourages employers to wait until they receive their individual notice.

How to ensure. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under workers comp. Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax.

653026 Nonurban county defined for ORS 653025. Color-coded maps of the US. Your tax rates may fluctuate during the 2022 2024 period due to tax schedule changes.

Employers and employees split the cost evenly. The WBF assessment rate. They were sent separately to employers in De-cember of last year.

Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year. These coronavirus stimulus checks from Oregon however would go only to low-income workers. Additionally an employers UI tax experience rating for 2022 through 2024 will roll back to the pre-pandemic 2020 UI experience rate benefit ratio.

However the rate will be based on your experience rate prior to the pandemic. NE Salem Oregon 97301. What is the Oregon WBF tax rate.

The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation. Oregon Combined Tax Payment Coupons Form OR-OTC arent in this booklet. This tax rate is the same for all.

Virtual public hearing set for Thursday Sept. In Oregon the state deposits money collected from state payroll taxes into a trust fund that is used to pay UI benefits to unemployed Oregon workers. Employers contribute not less than half of the hourly assessment 11 cents per hour and deduct not.

Workers Benefit Fund assessment.

Oregon Workers Benefit Fund Wbf Assessment

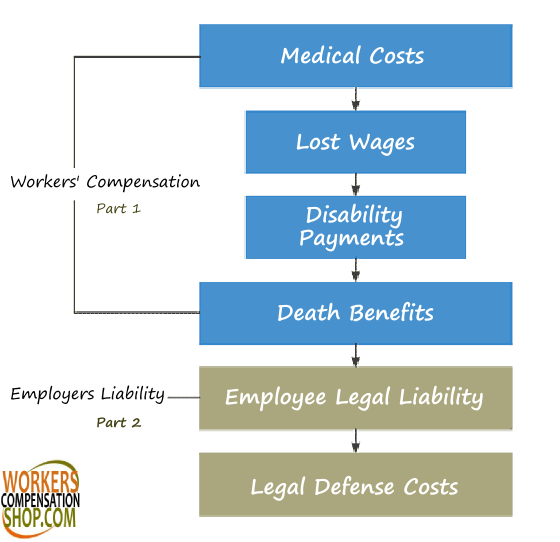

Workers Compensation Insurance Workmans Comp Insurance Quotes

How Much Is Workers Compensation Insurance In Ny

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Workers Compensation Impairment Rating Evaluations Guide

South Carolina Workers Comp Insurance Laws

What Is Workers Compensation Fraud Fighting Fraudulent Claims

California Meal And Rest Breaks For 1099 Independent Contractors Laws Workers Compensation Attorney

Washington Workers Compensation Class Codes

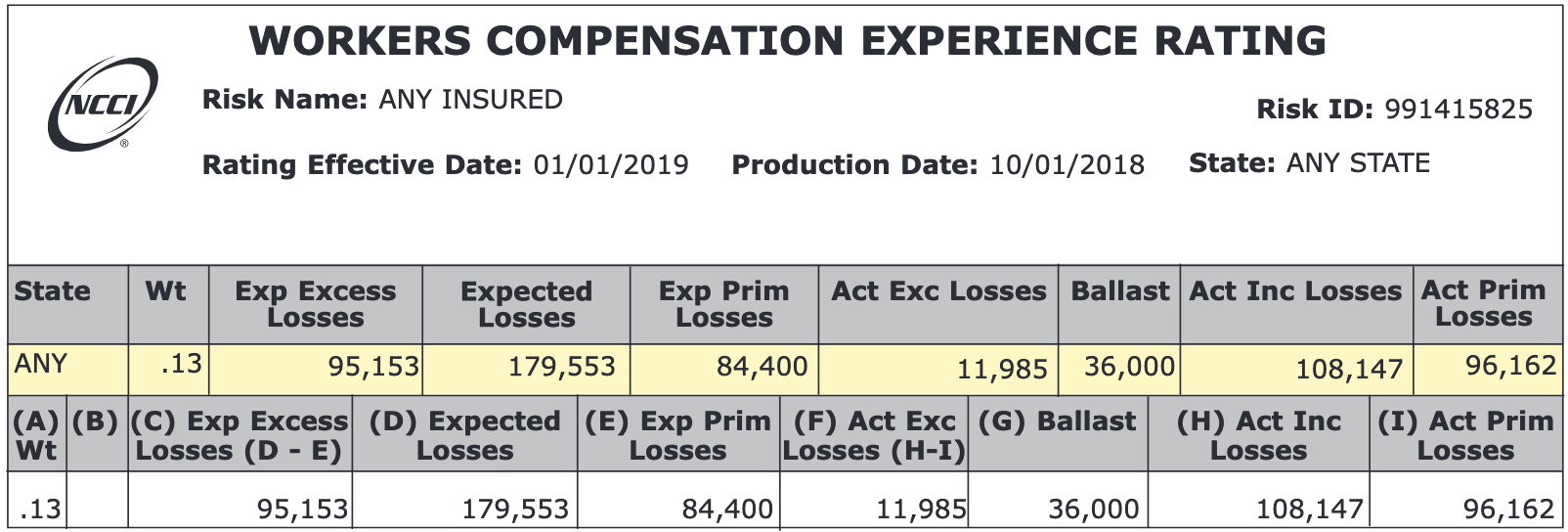

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

How Are Workers Compensation Benefits Calculated Foa Law

How Long Can A Workers Comp Claim Stay Open Canal Hr

Is Workers Comp Taxable Workers Comp Taxes

Wfr Oregon State Fixes 2022 Resourcing Edge

Oregon Workers Compensation Division Order Compliance Poster Employer State Of Oregon

Workers Comp Or Disability Which Is Better Kbg Injury Law

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon